alb3810483

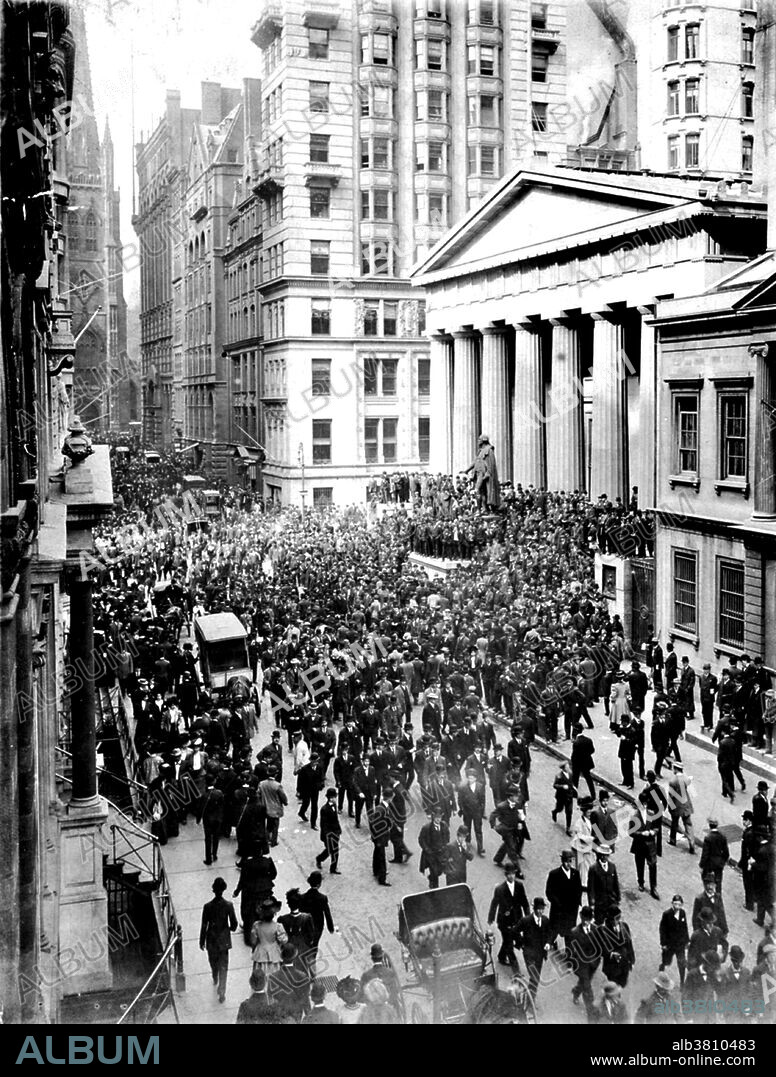

NYC, Knickerbocker Crisis, Panic of 1907

|

Zu einem anderen Lightbox hinzufügen |

|

Zu einem anderen Lightbox hinzufügen |

Haben Sie bereits ein Konto? Anmelden

Sie haben kein Konto? Registrieren

Dieses Bild kaufen

Titel:

NYC, Knickerbocker Crisis, Panic of 1907

Untertitel:

Siehe automatische Übersetzung

The Panic of 1907 was a financial crisis that occurred when the New York Stock Exchange fell almost 50% from its peak the previous year. It occurred during a time of economic recession, and there were numerous runs on banks and trust companies. The panic was triggered by the failed attempt in October 1907 to corner the market on stock of the United Copper Company. When this bid failed, banks that had lent money to the cornering scheme suffered runs that later spread to affiliated banks and trusts. On October 22, the Knickerbocker faced a classic bank run. From the bank's opening, the crowd grew. As The NY Times reported, "as fast as a depositor went out of the place ten people and more came asking for their money were asked to send some men to keep order". In less than three hours, $8 million was withdrawn from the Knickerbocker. Shortly after noon it was forced to suspend operations. The collapse of the Knickerbocker spread fear throughout the city's trusts as regional banks withdrew reserves from New York City banks. Panic extended across the nation as vast numbers of people withdrew deposits from their regional banks. At the time, the United States did not have a central bank to inject liquidity back into the market. The following year, Rhode Island Senator Nelson Aldrich established and chaired a commission to investigate the crisis and propose future solutions, leading to the creation of the Federal Reserve System.

Bildnachweis:

Album / Science Source / New York Public Library

Freigaben (Releases):

Model: Nein - Eigentum: Nein

Rechtefragen?

Rechtefragen?

Bildgröße:

3600 x 4753 px | 49.0 MB

Druckgröße:

30.5 x 40.2 cm | 12.0 x 15.8 in (300 dpi)

Schlüsselwörter:

Pinterest

Pinterest Twitter

Twitter Facebook

Facebook Link kopieren

Link kopieren Email

Email